This Week In Real Estate

|

||||||||||

| Printer Friendly Story View |

Click to play PODCAST:

Title Insurance Info Available from MBS Title.

The Ins and Outs of Obama's New Mortgage Refi Plan

Daily Real Estate News | Tuesday, October 25, 2011

Daily Real Estate News | Tuesday, October 25, 2011

President Obama announced Monday a plan to ease eligibility rules for home owners who want to refinance to take advantage of ultra-low mortgage rates and lower their mortgage payments. The administration hopes that by broadening its requirements for the Home Affordable Program that about 1 million home owners will now be able to qualify.

Here are more details about the newly announced changes to the program:

What is HARP?

It's a program started in 2009 that allows home owners to refinance their mortgages at lower rates without having to meet the typical requirement of having at least 20 percent of equity in their home to do so. Under current guidelines, many underwater borrowers have been ineligible for the program because their home values had to be no more than 25 percent below what they owed their lender. Also, some home owners were unable to afford the closing costs and appraisal fees to participate.

What's changing?

Many of the extra fees to participate in the program have been waived, and home owners' eligibility won't be contingent on how far their home's value has fallen.

Who's eligible?

Home owners with loans backed by Fannie Mae or Freddie Mac can participate. (Home owners can visit: freddiemac.com/mymortgage or fanniemae.com/loanlookup to determine if their mortgage is owned by either). Home owners must be current on their mortgage. When will it take effect? The changes could take effect by Dec. 1. HARP also is being extended through 2013 to allow more home owners the opportunity to qualify.

How successful will this be?

The administration hopes that by home owners being able to lower their monthly mortgage payments (with an average annual savings of $2,500 expected), they'll be more likely to stay current on their mortgage and avoid foreclosure. Also, the administration hopes that it will then free up household money to start spending more on other things, which could provide an overall boost to the economy. However, the administration says it realizes that aiding the housing market requires much more than a refinancing plan.

"This is only one piece of a broader strategy to help the housing market," says Housing Secretary Shaun Donovan. Donovan also notes federal efforts to help home owners who are delinquent on their mortgages and the unemployed.

Source: "A Guide to Administration's New Mortgage-Refi Plan," The Associated Press (Oct. 24, 2011) and "Refinancing Plan Won't Help Housing Market Much," CNNMoney (Oct. 24, 2011)

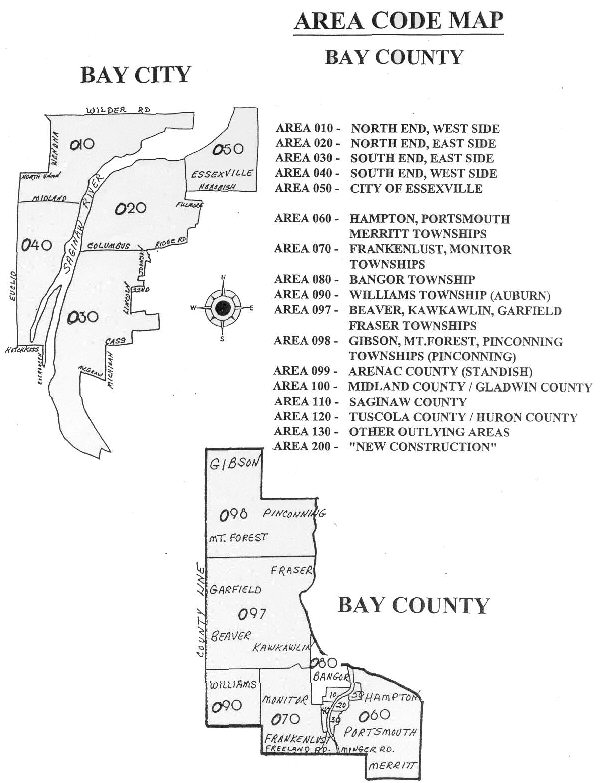

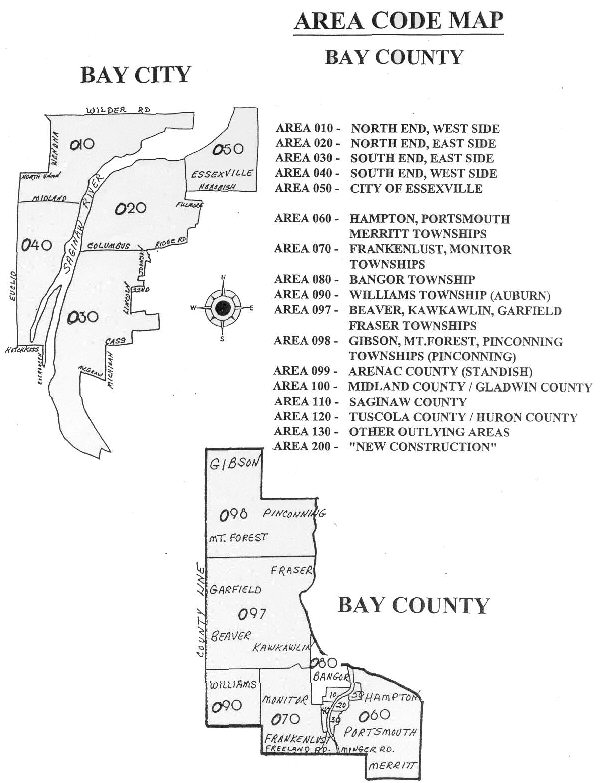

The following chart is for Bay County sales only.

THIS WEEK IN REAL ESTATE -- WEEKLY STATS

AREA # OF NEW LISTINGS PRICE RANGES

10 NORTH END, WEST SIDE - 5 - $21,400-$69,900

40 SOUTH END, WEST SIDE - 3 - $16,050-$95,000

20 NORTH END, EAST SIDE - 4 - $9,900-$499,900

30 SOUTH END, EAST SIDE - 6 - $16,500-$49,900

50 ESSEXVILLE - 2 - $36,900-$182,500

60 HAMPTON/PORTSMOUTH/MERRITT - 3 - $33,170-$99,900

70 FRANKENLUST/MONITOR TWP - 7 - $69,900-$259,000

80 BANGOR TWP - 4 - $79,900-$225,000

90 WILLIAMS TWP - 1 - $68,000

97 BEAVER/KAWKAWLIN/GARFIELD/FRASER - 1 - $279,000

98 PINCONNING/MT.FOREST/ GIBSON - 2 - $29,900-$123,000

AREA # OF SOLD LISTINGS PRICE RANGES

10 NORTH END, WEST SIDE - 2 - $8,250-$18,000

40 SOUTH END, WEST SIDE - 1 - $74,094

20 NORTH END, EAST SIDE - 3 - $7,000-$40,000

30 SOUTH END, EAST SIDE - 2 - $9,000-$70,000

50 ESSEXVILLE - 0 - $37,000-$112,000

60 HAMPTON/PORTSMOUTH/MERRITT - 0 - $40,000

70 FRANKENLUST/MONITOR TWP - 5 - $87,000-$207,000

80 BANGOR TWP - 3 - $13,000-$189,900

90 WILLIAMS TWP - 2 - $50,000-$68,000

97 BEAVER/KAWKAWLIN/GARFIELD/FRASER - 0 -

98 PINCONNING/MT.FOREST/ GIBSON - 0 -

TOTAL PENDING LISTINGS:

THERE ARE 27 LISTING PENDING.

THERE ARE 27 LISTING PENDING.

QUESTION CORNER: IF YOU HAVE A QUESTION ABOUT REAL ESTATE PLEASE SUBMIT IT HERE AND I WILL ANSWER IT IN THE NEXT COLUMN. YOUR NAME AND E-MAIL ADDRESS WILL NOT BE PUBLISHED. SUBMIT YOUR QUESTIONS TO: Click Here to E-Mail Jean Ann DeShano

Or Contact Jean Ann DeShano at:

414 Gies St., Bay City, MI 48706

(989) 233-8380

414 Gies St., Bay City, MI 48706

(989) 233-8380

Disclaimer: All of the sold, new listing, and stats in this column are from The Bay County Realtor Association web site.

| Printer Friendly Story View |

|

|

Jean Ann DeShano |

|

|

|

Printer-Friendly Story View

0200 Nd: 04-20-2024 d 4 cpr 0

12/31/2020 P3v3-0200-Ad.cfm

SPONSORED LINKS

12/31/2020 drop ads P3v3-0200-Ad.cfm