On the verge of recovery?

On the verge of recovery?

GM Economists See U.S. Employment Gains,

More Profits From Market Share

U.S. Economy Growing Strongly, GM's Ted Chu Tells Tri-County Economics Club

March 31, 2004

By: Dave Rogers

All economic news now is global, not local, members of the Tri-County Economics Club learned recently from a General Motors economist.

Ted Chu, manager of economic and industry analysis for GM, filling in for longtime presenter Paul Ballew, chief sales analyst for GM, told the club "global growth momentum remains strong, but some headwinds are developing."

The U.S. and emerging Asia are the twin growth engines for the global economy, according to Chu. "The U.S. economyis growing strongly, with business investment, exports and inventory adjustments expected to drive U.S. growth for 2004, in addition to sustained consumer demand." The weak U.S. dollar will provide a stimulus for exports, he said.

Ballew'srecent comments about industry trends were interpreted as indicating GM is no longer pushing for market share gains, being satisfied with stability at the about 28 percent of the market it has held for the past five years.

Spokesmen for other U.S. automotive firms said increases in market shares were not the goal, but instead more profits were sought from present sales levels.

Last year U.S. companies lost ground to imports from Japan and Germany. Ford's slice of the market in North American slipped to 20.7 percent from 21.3 percent a year ago, GM dropped to 28.3 percent from 28.7 percent and Chrysler skidded to 12.8 percent from 13.1 percent.

U.S. automakers had about 80 percent of the North American market 20 years ago; now that share is 61.8 percent, according to reports by Ward's AutoInfoBank.

GM's Chu cited "economic fundamentals supportive of a broad-based expansion," including strong productivity gains, declining risk premiums and rising profits bolstering capital spending. He sees low interest rates, competitive pricing, expanding net worth and tax refunds as aiding consumer spending in the next year.

Chu estimates that vehicle sales will total 17-17.3 million units in 2004, up slightly from 2003.

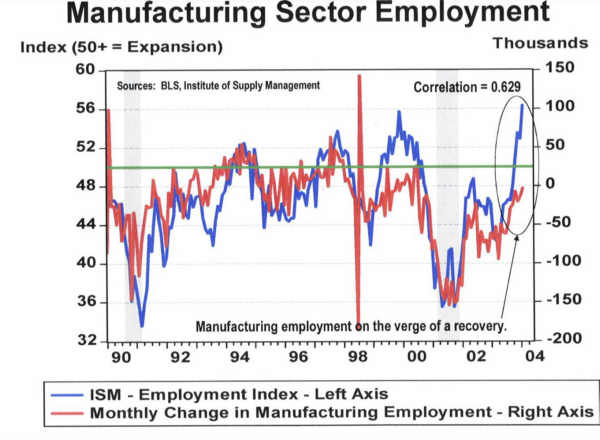

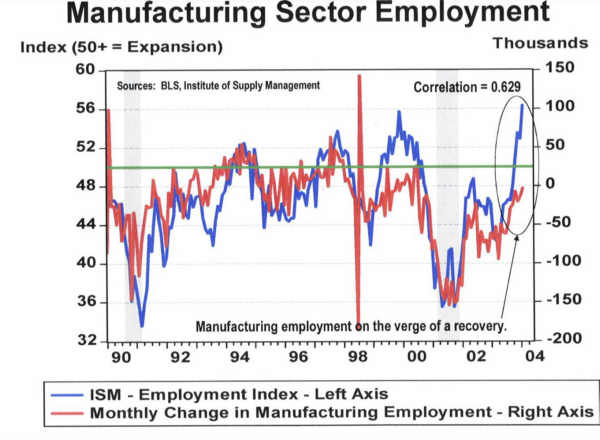

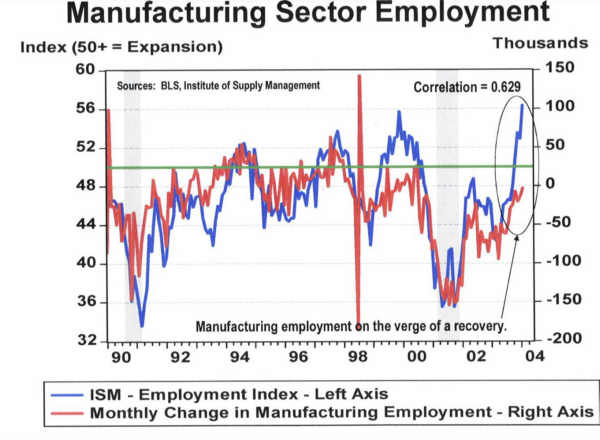

Manufacturing sector employment is seen by Chu as "on the verge of a recovery," although he said "weak employment growth in the U.S. is having a significant impact on China." Rising protectionism in the U.S. is a concern for China, which fears that its economic growth is too strong.

Global steel prices, for example, have shot up about 60 percent because of unprecedented demand from China, other forecasters have noted.###